It comes as no surprise this Labor Day that working Americans believe Social Security and Medicare are crucial to their financial security and health in retirement and that they fear politicians are deciding the future of those programs behind closed doors.

A recent nationwide survey commissioned by AARP, which formerly was the American Association of Retired People, found that 80 percent to 90 percent of those asked are worried about the so-called "entitlement programs" to which they have been contributing for most of their working lives.

On Social Security, the survey found that non-retired baby boomers feel "great economic anxiety across party lines." These pre-retirees' concerns were reflected in something called an "anxiety index" that measured their worries on issues such as prices rising faster than incomes, health expenses and retirement security. The group also said it felt that its economic problems were made worse by political gridlock.

Those pre-retirees are the working people we celebrate today, baby-boomers who have spent 30 or 40 years paying into safety net programs created by Democratic congresses during the New Deal (Social Security) and the Great Society (Medicare). Now, because of their vast numbers and longer lifespans and skyrocketing costs of medical care, the programs are not sustainable at current funding levels.

AARP is a powerful lobby with 37 million members age 50 and over. Its current national education program is aimed at discouraging Congress from making what AARP considers to be unfair cuts in benefits from the two programs. AARP is promoting the program through town hall meetings, online member surveys, national advertising and visits with news organizations.

AARP says its education program will not be used for direct lobbying or in campaigns in the upcoming elections. The organization said it merely wants to communicate to Congress and government officials the concerns of its members and others who join the conversation.

But with each of the presidential campaigns accusing the other of wanting to slash Medicare funding, it already has emerged as a key issue. Neither party has yet addressed the Social Security "third rail" in a meaningful way, but Medicare is the political hot potato of the moment. Partisan battles aren't helping to engage taxpayers in any sort of meaningful discussion.

The parties are flinging around numbers like $716 billion — with Republicans saying that's how much President Barack Obama's health care reforms will "cut" from Medicare in 10 years and Democrats retorting that the cuts actually are 'savings" forecast by the nonpartisan Congressional Budget Office.

Besides, Democrats say, the House budget bill authored by Republican vice presidential nominee Rep. Paul Ryan of Wisconsin envisions the same levels of cuts/savings. And Ryan has proposed turning Medicare into a voucher program by 2023. The value of the vouchers are not likely to keep pace with rising medical cost, forcing seniors to pay significantly more out of pocket for medical care.

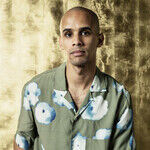

Barry Rand, AARP's CEO, has said, "Instead of talking about balancing the budget on the backs of America's seniors, they [Congress and political leaders] should be talking about ways to strengthen [the programs].

"We all know Washington isn't listening and that the only way to get them to listen is to get you involved," Rand added. "AARP is listening even if Washington is not listening. There is no American dream if you don't have Medicare and Social Security."

The results of an AARP-commissioned national telephone survey of adults of all ages in July indicate the conversation can't get started too soon.

The survey found that the concern over retirement security was a major component of economic anxiety. Of the survey respondents, 72 percent "believe they will have to delay retirement"; 65 percent said they worried they won't have "a comfortable retirement"; and 50 percent don't think they will ever be able to retire.

The problem with such surveys is that most people have no idea how Social Security and Medicare work. They know only that they've paid into the programs on the assumption that whatever they've paid will be there for them when they retire.

In fact, according to a study by the nonpartisan Urban Institute, most people will get far more back in benefits than they've paid in more than twice as much in the case of single taxpayers earning low to moderate incomes. Even married couples earning as much as $125,000 a year can expect lifetime benefits of $100,000 or more than they've paid in.

With baby boomers retiring and with today's workers less likely to earn solid middle-class incomes with fewer Americans gobbling up more of the nation's wealth, this is simply not sustainable.

It is a complicated problem defying the simplistic solutions offered by pandering politicians from both parties. AARP's members have every right to be concerned. But people who are 40 years from retiring should be even more worried.

REPRINTED FROM THE ST. LOUIS POST-DISPATCH

View Comments